Process: Lead to Cash for B2B SaaS

Most organizations have capable people doing individual tasks. The failure mode isn't competence; it's handoffs.

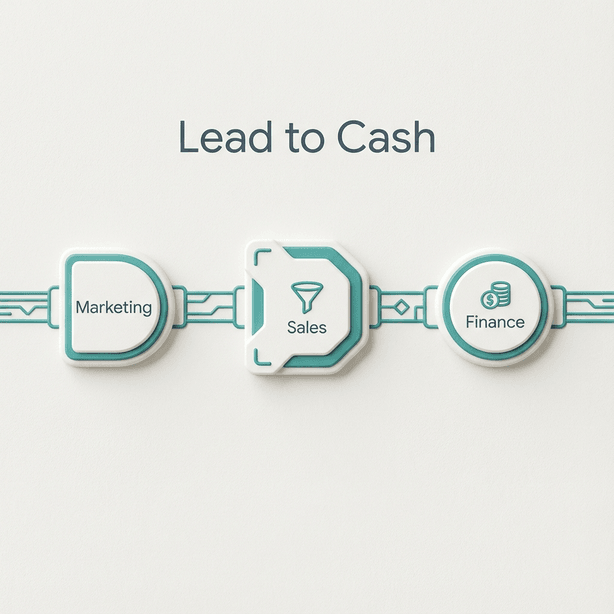

Lead to Cash for B2B SaaS (PROC-REV-LEAD-TO-CASH-01) is the canonical workflow for converting market attention into bank balance. It orchestrates 3 tasks across Marketing, Sales, and Finance to ensure that pricing strategy reliably converts into collected cash.

Without this process, you get "bookings" that never turn into cash, or leads that die because pricing is misaligned. With it, you get a predictable Revenue Ops engine.

Process Stats

- Steps: 3

- Cross-Functional: Marketing → Sales → Finance

- Primary KPI: Net New ARR

- Valuation Impact: Revenue, Cash Flow, Risk

The Workflow Map

graph LR

%% Nodes

start((Start))

subgraph "Phase 1: Marketing"

S1[[Step 1: Pricing A/B Test]]

end

subgraph "Phase 2: Sales"

S2[[Step 2: Outbound Sequence]]

end

subgraph "Phase 3: Finance"

S3[[Step 3: Cash Flow Forecast]]

end

end((End))

%% Edges

start --> S1

S1 --> S2

S2 --> S3

S3 --> end

%% Click events

click S1 "/blog/posts/m-001"

click S2 "/blog/posts/s-001"

click S3 "/blog/posts/f-001-build-monthly-cash-flow-forecast"Orchestration Logic:

- Step 1 (Marketing): Validate pricing to ensure offer viability.

- Step 2 (Sales): Generate pipeline using validated pricing.

- Step 3 (Finance): Forecast the resulting cash flow to manage runway.

Execution Walkthrough

Step 1: Design and run pricing A/B test

Task ID: M-001 (coming soon)

Role: GFE-2.1.0 (Marketing Designer)

Tools: HubSpot, Outreach

The Work:

Design, implement and analyse a controlled pricing experiment for a target segment. Before pouring fuel on the fire (outbound), we must ensure the unit economics work. This step tests hypothesis, rollout, and decision.

Critical Handoff:

Produces a validated pricing model and target segment that Sales uses in Step 2 to craft their outreach messaging.

Deep Dive

How to execute this step: Design and run pricing A/B test (coming soon)

Step 2: Design and launch outbound email sequence

Task ID: S-001 (coming soon)

Role: GFE-1.2.0 (Sales Designer)

Tools: HubSpot

The Work:

Design, implement and launch a multi-touch outbound email sequence for the specific ICP identified in Step 1. This involves list building, messaging, cadence, and execution.

Critical Handoff:

Produces Qualified Opportunities and Bookings. These bookings are the raw input for Finance in Step 3 to forecast cash collections.

Deep Dive

How to execute this step: Design and launch outbound email sequence (coming soon)

Step 3: Build monthly cash flow forecast

Task ID: F-001

Role: GFE-0.0.2 (Finance Designer)

Tools: Zoho Books

The Work:

Prepare a 12-month operating cash flow forecast that ties to revenue, expense, and working capital assumptions. This step reconciles the "Bookings" from Step 2 into actual "Cash" in the bank, accounting for payment terms and churn.

Critical Handoff:

Produces the Cash Runway Forecast used by leadership to make hiring and investment decisions.

Deep Dive

How to execute this step: Build monthly cash flow forecast

Minimum Viable Pod

To run this process at scale, you need the following Skill Signatures:

| Role | Signature | Responsibility |

|---|---|---|

| Marketing Lead | GFE-2.1.0 | Owns pricing strategy and experiment design |

| Sales Lead | GFE-1.2.0 | Owns pipeline generation and sequence optimization |

| Finance Lead | GFE-0.0.2 | Owns cash visibility and reconciliation |

Tooling Stack

This process requires integration between:

- CRM: HubSpot (Shared truth for Leads and Deals)

- Sequencer: Outreach (Execution of Step 2)

- ERP: Zoho Books (Execution of Step 3)

Note: GFE is tool-agnostic, but these categories are required.

Measuring Success

If this process is working, these KPIs will move:

Net New ARR (coming soon)

- Why: Validated pricing + effective outreach = New Revenue.

- Target: Positive Trend

Operating Cash Flow

- Why: Revenue is vanity, cash is sanity. This process ensures bookings turn into cash.

- Target: Positive Trend

ValuationOps Connection

This process anchors the Revenue Ops layer of the GFE ValuationOps stack.

The Value Chain:

- Orchestration: You connect Marketing strategy to Sales execution to Finance reality.

- Velocity: Cycle time decreases as pricing friction is removed in Step 1.

- Efficiency: CAC Payback improves as you target the right segments.

- Valuation: Revenue predictability increases, increasing the revenue multiple.

Law 7: Processes → KPIs → Valuation

You cannot fix valuation directly. You fix the process, which moves the KPI, which drives the valuation.

Traceability Chain

ValuationOps Layer: Revenue Ops (coming soon)

Related OKRs:

- OKR-2025-Q1-01 (coming soon)

Component Tasks:

- M-001: Design and run pricing A/B test (coming soon)

- S-001: Design and launch outbound email sequence (coming soon)

- F-001: Build monthly cash flow forecast

FAQ

Q: How long does this end-to-end process take?

A: A typical cycle is 30-60 days. Pricing tests (2 weeks) → Outbound campaign (4 weeks) → Cash collection (Net 30).

Q: Can this be automated?

A: Step 2 (Outbound) is highly automatable with AI agents. Step 1 (Strategy) and Step 3 (Reconciliation) require human judgment (L2+).

Q: Who owns this process?

A: The Revenue Operations Lead (typically GFE-3.3.2) owns the end-to-end orchestration, ensuring handoffs don't drop.

Q: What is the most common failure point?

A: The handoff between Sales and Finance. Sales closes deals with payment terms that Finance hasn't approved, leading to cash flow surprises.