Higher Education Degrees

Snippet summary: Online higher‑education degrees are expanding rapidly, but the OPM business model is fragmenting under regulatory scrutiny, CAC inflation, and AI‑driven delivery shifts—creating a window for universities to bring delivery in‑house and for investors to target infrastructure over revenue‑share models.

Executive Summary

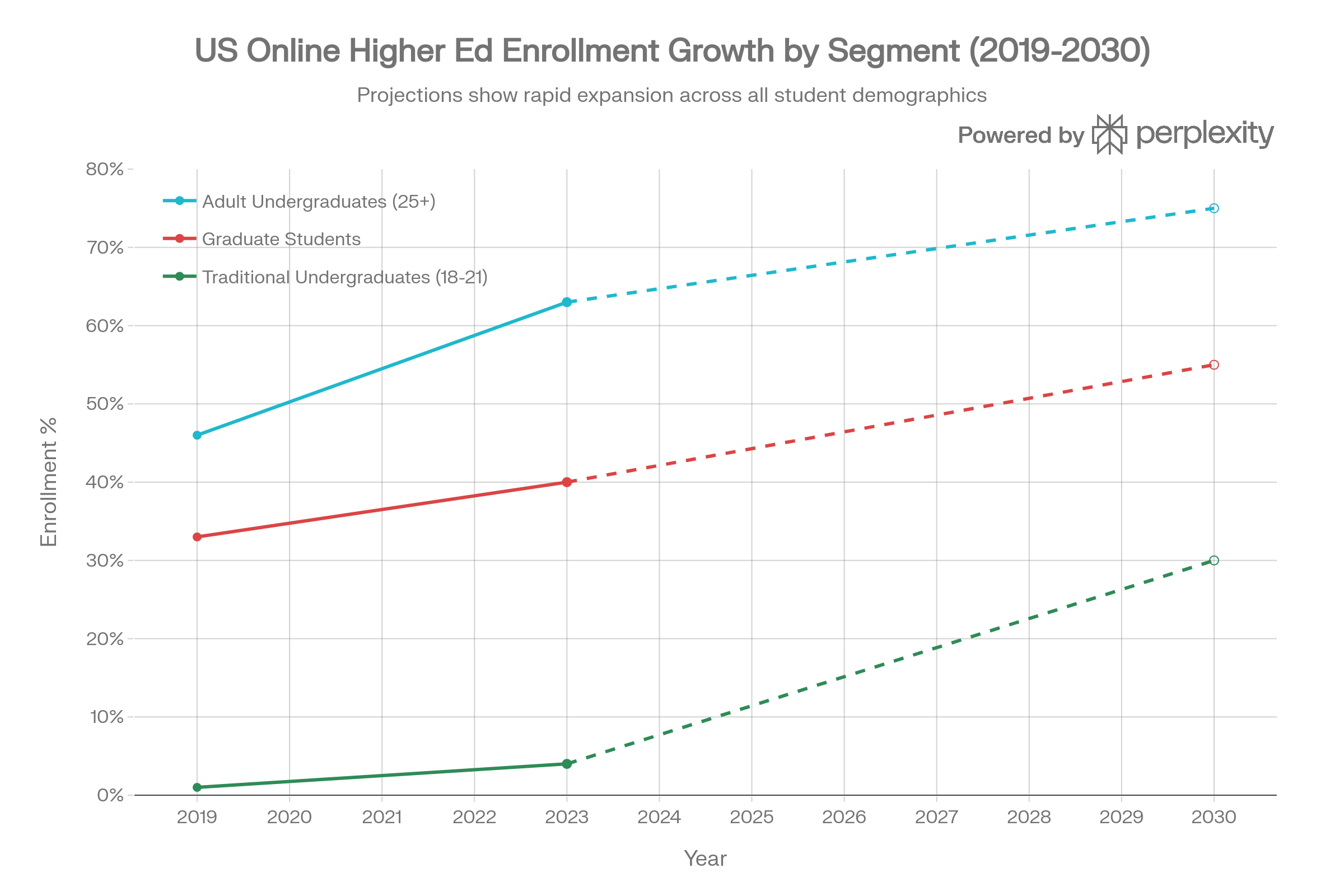

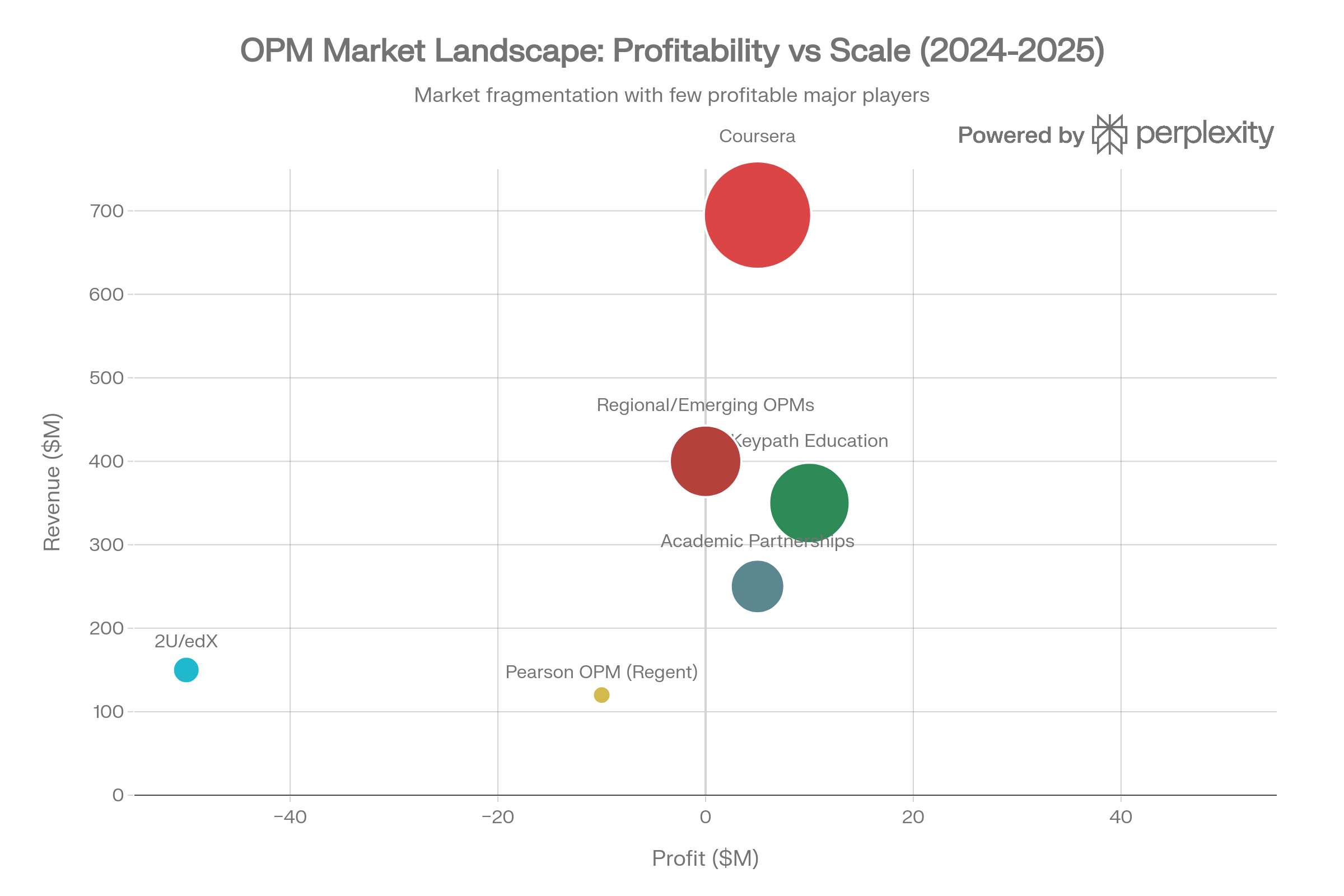

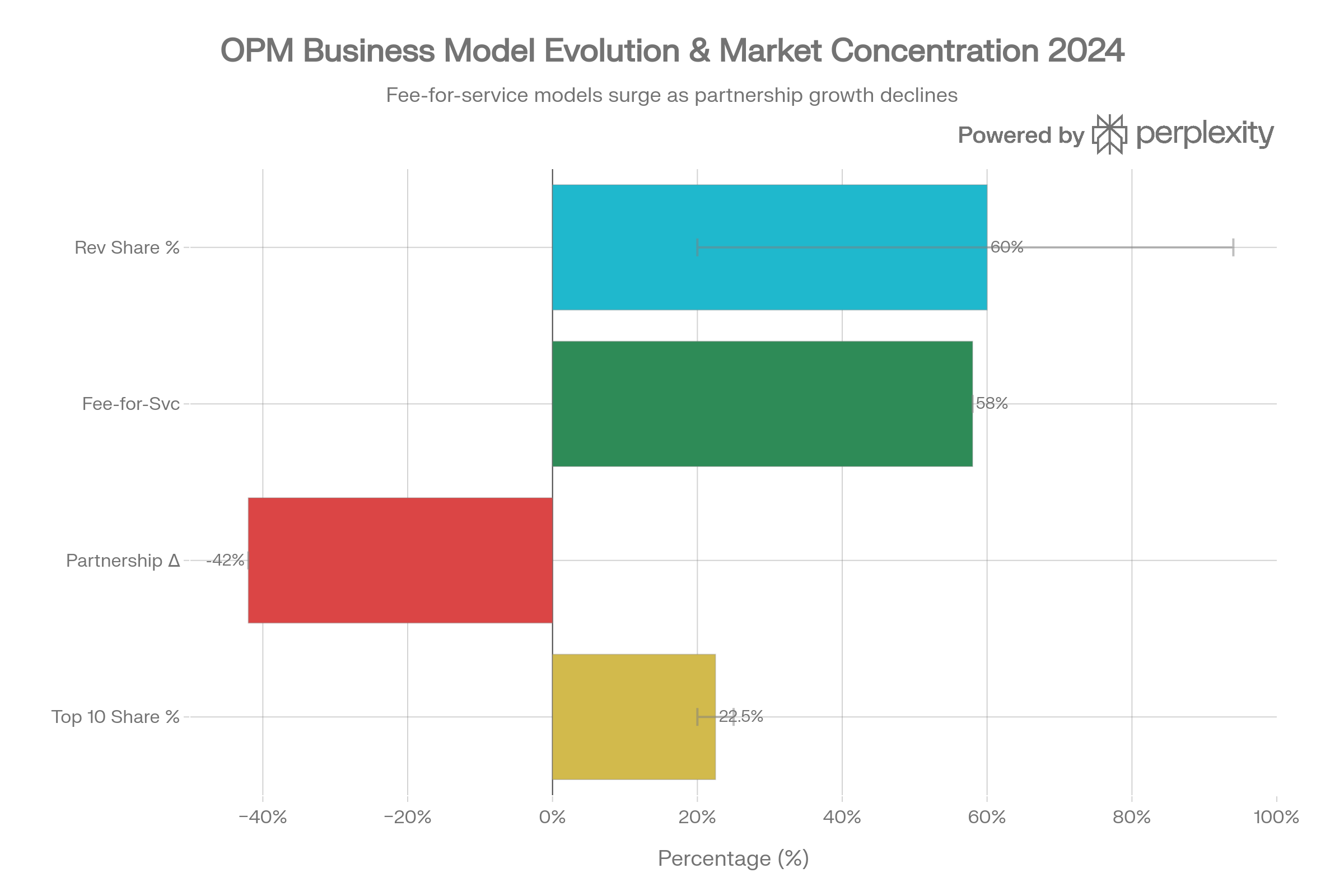

- Facts: The OPM market is ~$3.2B (2024) with projections toward ~$7.7B by 2025–2026, but revenue‑share models (50–94% tuition share) are rapidly shifting to fee‑for‑service arrangements amid regulatory pressure and university pushback. The online degree sector is now a core survival channel for many regional universities facing demographic cliffs and declining state funding.

- Interpretation: The historical OPM value proposition—cash‑flowing marketing + program build‑out in exchange for tuition share—no longer holds at scale. Universities are internalizing capabilities or renegotiating contracts, while AI compresses content‑production costs and changes learner support models.

- Forecast (12–36 months): Expect a steady transition toward in‑house online program teams, rising CAC for mid‑tier institutions, and a bifurcation between premium branded degrees and competency‑based, AI‑augmented programs.

I. Scope and Market Definition

What Is Included

- Accredited online or hybrid undergraduate and postgraduate degrees delivered by regionally accredited institutions.

- OPM service models: platform delivery, instructional design, marketing, recruitment, enrollment management, and student support.

- Hybrid degree delivery models with synchronous and asynchronous components.

- Student lifecycle management, including retention and completion support.

What Is Excluded

- Non‑degree bootcamps, micro‑credentials, and short‑form certificates (unless embedded in degree pathways).

- Corporate L&D or enterprise training programs.

- MOOCs or free consumer learning platforms.

- K‑12 online education and non‑credit vocational programs.

Why This Sub‑Vertical Is Systemically Important

- Access & equity: Online degrees unlock access for working adults and rural learners; India has seen 50%+ growth in online enrollment over two years.

- Institutional survival: Many regional universities depend on online enrollment for revenue stability.

- Labor‑market responsiveness: Online programs adapt curricula faster than campus‑only programs, enabling closer alignment to employer skill needs.

II. Value Chain & Ecosystem Architecture

Front‑End: Learner‑Facing Delivery

Jobs to be done: lead generation, flexible learning experience, career outcome signaling, and continuous support.

Revenue models: tuition per semester; flat per‑student service fees; occasional outcome‑based employer partnerships.

Incumbents vs challengers:

- Incumbents: ASU Online, SNHU, WGU, Grand Canyon, UMass Global.

- Challengers: Open universities in India (IGNOU expansion, Symbiosis), and lean regional operators.

Middle Layer: Content, Curriculum, Platforms & Trust

Jobs to be done: instructional design, platform delivery (LMS), assessment integrity, accreditation alignment.

Platforms & services: Canvas, Blackboard, Moodle, and OPM‑built LMS stacks; proctoring via Honorlock, ProctorU, Examity.

AI pressure: GenAI shortens curriculum build time by 30–40%, commoditizing instructional design and reducing OPM leverage.

Back‑End: Data, Finance, Certification

Jobs to be done: payment management, credential verification, compliance, and outcomes analytics.

Key tension: Universities are reclaiming data ownership from OPMs; credential portability (CLR, digital wallets) threatens legacy transcript systems.

III. Key Players & Roles

United States

- Institutional incumbents: ASU Online, SNHU, WGU, Grand Canyon, UT Austin Online.

- OPM and service providers: 2U (post‑bankruptcy), Coursera, Keypath, Academic Partnerships.

- Big Tech: AWS Training, Google Cloud education partnerships, Microsoft Learn integrations.

Control points: Universities own admissions and credentials; OPMs influence marketing funnels and engagement analytics.

India

- Institutional incumbents: IGNOU, state open universities, Manipal, Symbiosis, BITS Pilani Online.

- Regulatory influence: UGC/ODL guidelines and approval lists determine market access.

Control points: Institutions retain curriculum and learner data; outsourcing is limited versus the US.

Gulf (Secondary)

- Regulators: UAE and Saudi recognition frameworks emphasize accreditation in home country and credential verification.

- Market role: Primarily a demand‑side market for US/India degrees rather than a supply‑side hub.

IV. Economics & Metrics That Matter

Unit Economics Benchmarks

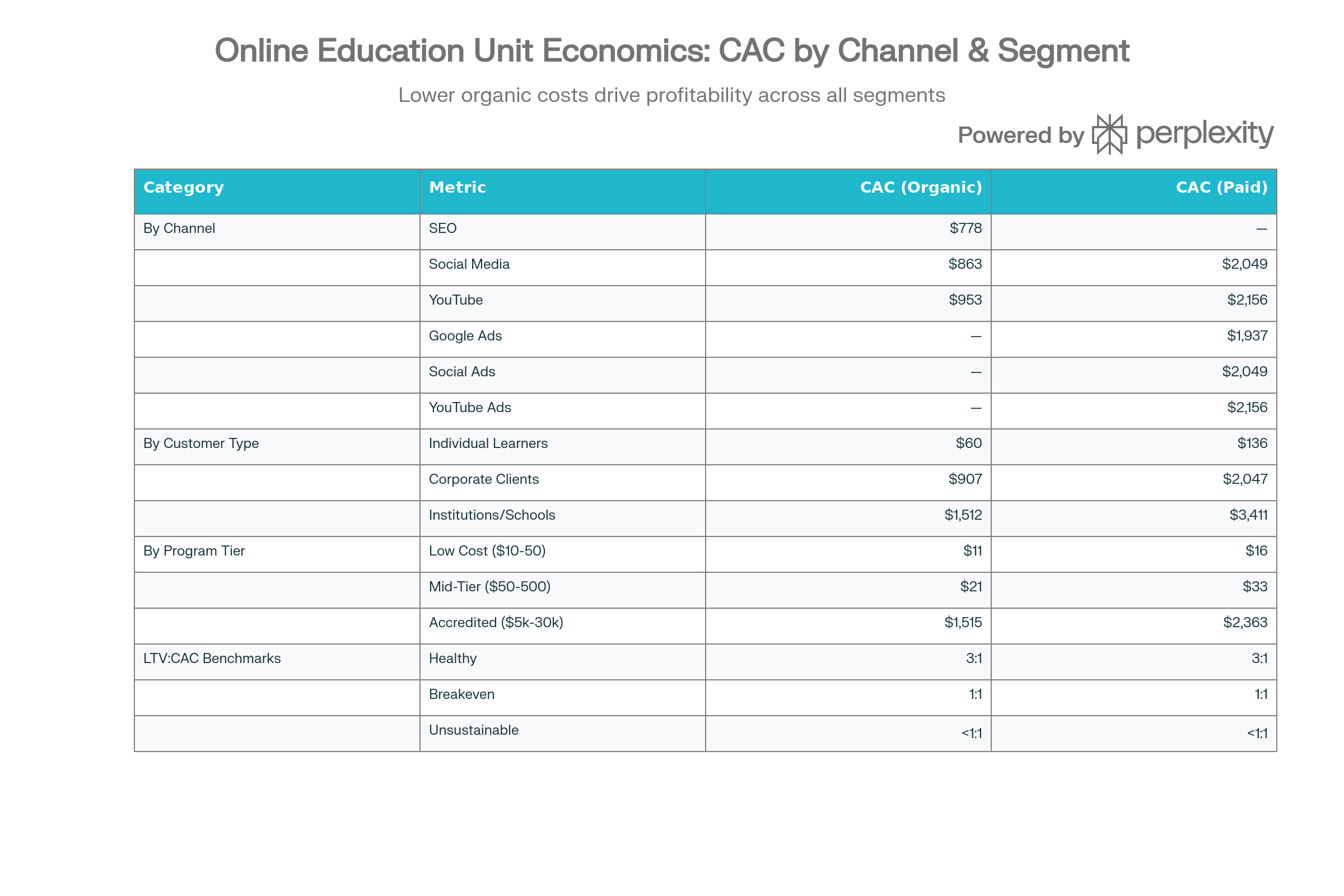

| Metric | US Online Degree (Range) | India Online Degree (Range) | Decision‑Grade Implication |

|---|---|---|---|

| CAC | $1,515–$2,363 | $80–$250 | CAC inflation is the primary profitability risk in the US; India wins on payback speed. |

| ARPU (annual) | $3,750–$15,000 | $500–$3,000 | US pricing supports premium branding; India relies on scale. |

| Completion | 36–46% (online) | 45–60% | Low completion compresses LTV and increases regulatory risk. |

| Payback | 18–36 months | 12–24 months | US payback depends on retention; India depends on volume. |

CAC by Channel (Online Programs)

Interpretation: Organic acquisition yields 60–70% lower CAC than paid; programs without strong SEO/brand moats face margin compression.

V. Regulatory & Policy Landscape

United States

- Facts: Title IV eligibility hinges on “regular and substantive interaction”; SARA enables multi‑state delivery; 2025 rules add stricter proctoring and gainful employment thresholds (Federal Register, Jan 2025).

- Interpretation: Regulatory tightening increases compliance costs ($500K–$2M annually for large programs) and squeezes high‑share OPM contracts.

India

- Facts: UGC ODL/Online regulations restrict eligibility to NAAC/NIRF‑ranked institutions; online enrollment capped at 3x on‑campus capacity; 100+ universities approved for online delivery (2025).

- Interpretation: Gatekeeping prevents race‑to‑the‑bottom pricing, protecting quality and slowing rapid private OPM consolidation.

Gulf (Secondary)

- Facts: UAE recognition requires home‑country accreditation and verification via DataFlow/QuadraBay; processing within ~30 days.

- Interpretation: Gulf demand is a secondary growth lever for US/India universities, not a primary delivery market.

VI. AI Impact Analysis

Where AI Improves Efficiency (Incremental)

- Facts: GenAI reduces instructional design costs 30–40% and automates grading/feedback at scale.

- Interpretation: OPM design margins compress; universities can internalize content production with lower capex.

Where AI Changes Pedagogy (Structural)

- Facts: Adaptive tutoring and competency‑based progression lift retention by 10–20 pp in early pilots.

- Interpretation: Semester‑based cohorts fragment; institutions bifurcate into premium cohort experiences and scalable competency‑based models.

Moats Created and Eroded

- Moat creation: proprietary learner‑outcomes data, employer feedback loops, AI‑based early‑warning systems.

- Moat erosion: content libraries and generic instructional design services.

New Risks

- Integrity risk: GenAI‑assisted cheating threatens credential credibility.

- Equity risk: personalization can widen gaps for low‑connectivity learners.

VII. Capital Stack & Incentives

- Facts: US capital is repricing away from OPM revenue‑share models; 2U’s bankruptcy and Coursera’s shift toward enterprise revenue illustrate the trend.

- Interpretation: Capital is moving to institutional SaaS, assessment integrity, and AI‑native tutoring platforms rather than full‑service OPMs.

- India: Financing is dominated by government and philanthropic capital (SWAYAM, state ODL); VC focus is limited in degree credentials due to lower ARPU and long sales cycles.

VIII. Competitive Landscape

Facts: OPM contracts are shifting from 60–80% tuition share to flat‑fee service models; universities are increasingly exiting or renegotiating contracts.

Interpretation: The OPM market is structurally over‑supplied. Winners will be niche specialists (healthcare, engineering) or infrastructure enablers, not generalist revenue‑share providers.

IX. Predictions & Futures (12–36 Months)

| Prediction | Confidence | Horizon | Leading Indicators | Falsification Trigger |

|---|---|---|---|---|

| Universities internalize delivery; OPM share falls materially | High | 12–24 months | OPM contract exits, VP Online hires | New Tier‑1 OPM mega‑deals |

| CAC inflation compresses mid‑tier margins | High | 18–36 months | Paid CAC growth, tuition flatlining | Employer‑funded pipelines reduce CAC |

| Competency‑based models rise to ~40% of online enrollments | Medium | 24–36 months | Accreditors loosen competency guidance | Accreditor clampdown |

| India online degree intake exceeds 500k annually | Medium | 18–30 months | UGC approvals, private enrollment data | Tightened approval caps |

| AI‑safe assessment becomes a premium differentiator | High | 12–24 months | New accreditor guidance, vendor growth | Employers ignore verification |

X. Executive Implications

For University Executives

- Build vs partner: If enrollment target >5,000 and internal marketing capability exists, in‑house models beat revenue‑share economics within 18–30 months.

- Compliance posture: Budget for AI integrity and proctoring now; it will be table‑stake in 2026.

- Pricing discipline: Premium tuition only sustainable with clear employer outcomes; avoid price inflation without brand strength.

For Investors

- Prioritize: AI‑native assessment, student success analytics, institutional SaaS; avoid generalist OPM revenue‑share models.

- Look at: Healthcare and skilled‑trades degree enablement with employer pipelines and higher completion rates.

For Founders

- White space: Integrity‑first assessment, workflow unification (CRM + LMS + outcomes), and regional university enablement in India.

XI. Curated Research & Sources

XII. Signals to Monitor (12–36 Months)

- OPM partnership exits vs new deals (structural health indicator).

- Tuition pricing trend for mid‑tier institutions (CAC pressure signal).

- Accreditor guidance on AI usage and competency assessment.

- Employer preference shifts for online vs in‑person degrees.

- India UGC approval cadence and private enrollment growth share.

FAQs

What is included in higher education degrees?

Accredited online and hybrid undergraduate/postgraduate programs delivered by universities, often via OPM platforms or internal teams.

What is excluded from this segment?

Bootcamps, micro‑credentials, MOOCs, and corporate training programs without accredited degree outcomes.

Why does the OPM model matter so much?

OPMs shape marketing, enrollment, and learner support economics; as revenue‑share models collapse, universities regain margin and control.

References

Show full reference list

- https://www.holoniq.com/notes/the-anatomy-of-an-opm-and-a-7-7b-market-in-2025

- https://www.linkedin.com/pulse/online-program-management-higher-education-market-size-i57ze

- https://investor.coursera.com/news/news-details/2025/Coursera-Reports-Fourth-Quarter-and-Full-Year-2024-Financial-Results/

- https://www.highereddive.com/news/2u-flat-fee-model-opm-online-degrees/693330/

- https://www.insidehighered.com/news/tech-innovation/teaching-learning/2025/02/19/fewer-colleges-sharing-profits-opms

- https://protectborrowers.org/opm-contracts-reveal-risks-for-students-and-universities/

- https://www.bestcolleges.com/news/students-less-likely-complete-fully-online-degree-program/

- https://www.federalregister.gov/documents/2025/01/03/2024-31031/program-integrity-and-institutional-quality-distance-education-and-return-of-title-iv-hea-funds

- https://deb.ugc.ac.in/Latest/OL

- https://timesofindia.indiatimes.com/education/news/ugc-approves-101-universities-for-online-and-distance-learning-in-academic-session-2025-26-check-details-here/articleshow/124360410.cms

- https://studyportals.com/articles/indias-online-revolution-in-higher-education/

- https://news.uppersetup.com/education/2025/03/10/uae-ministry-updates-regulations-for-recognizing-foreign-online-degrees/

- https://en.wikipedia.org/wiki/Online_program_manager

- https://www.highereddive.com/news/status-update-the-state-of-opm-university-partnerships/562888/

- https://www.edsurge.com/news/2024-04-22-are-colleges-ready-for-an-online-education-world-without-opms