Test Prep & Professional Certifications

Snippet summary: Test prep and professional certification platforms help learners pass standardized exams and credentials (SAT, GMAT, NEET, CFA, PMP), with rapid AI‑driven content commoditization, strong policy sensitivity in India, and durable moats held by certification bodies.

Executive Summary

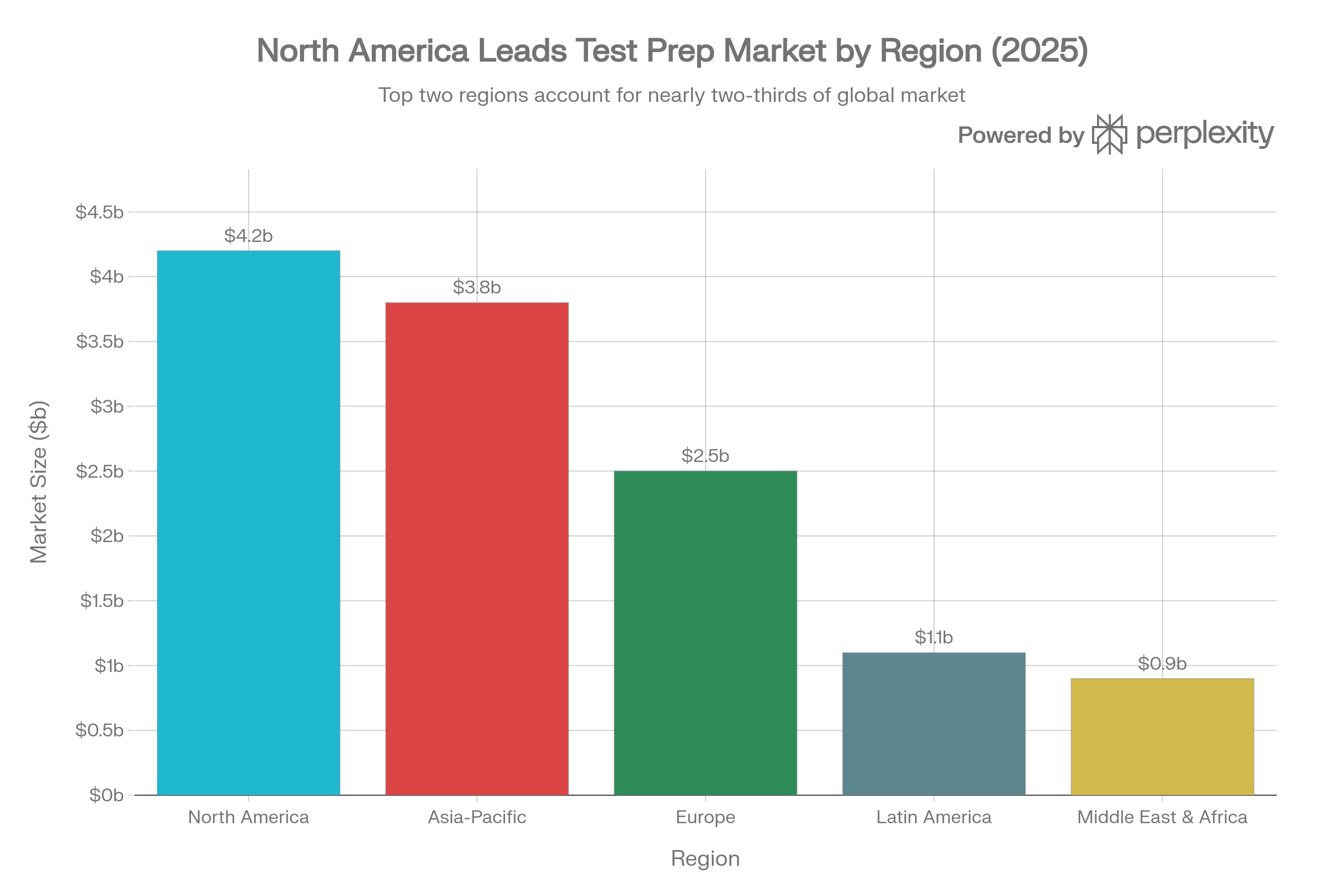

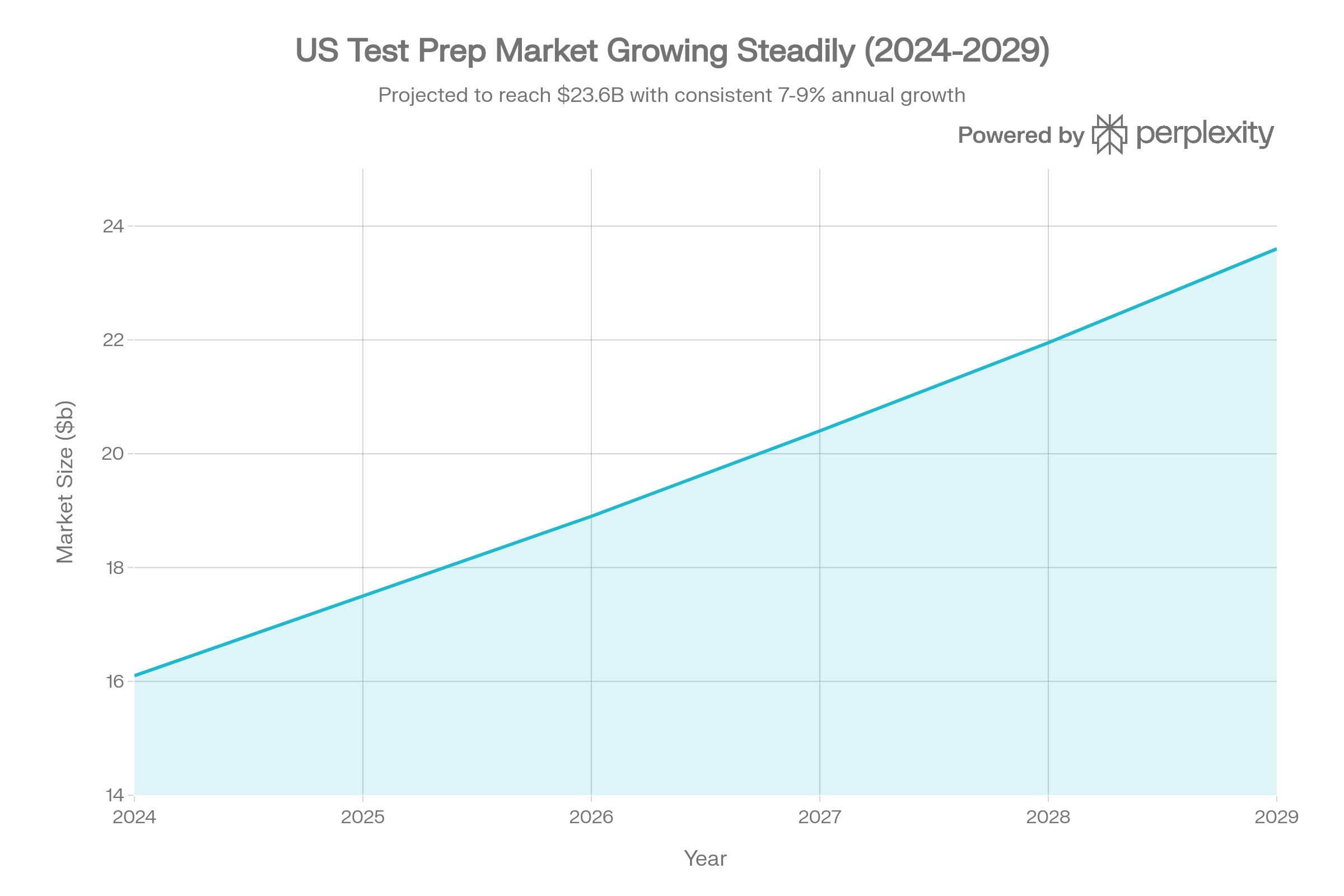

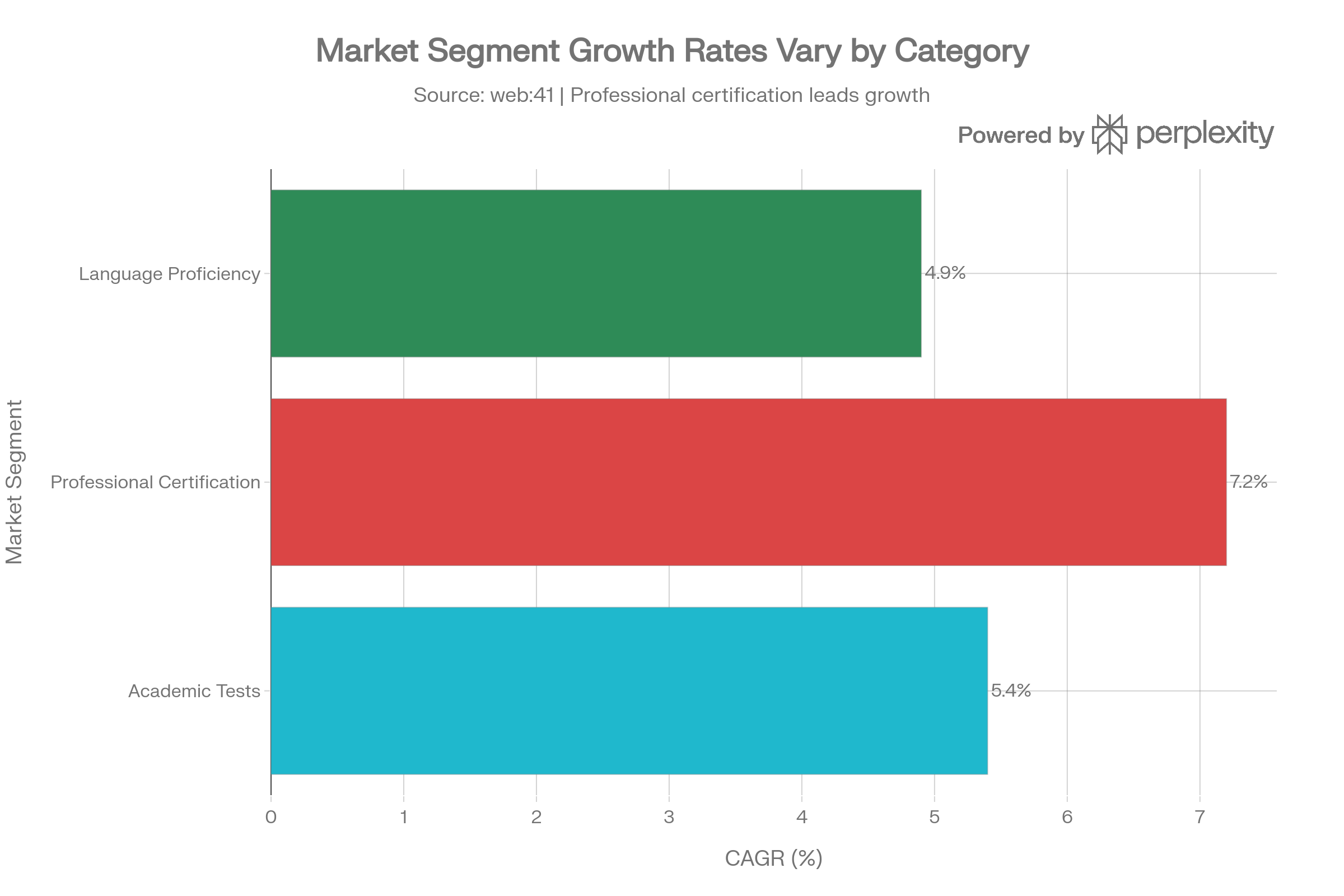

The Test Prep & Professional Certifications market is a $12.5B global vertical at an inflection point, facing AI‑driven content commoditization, regulatory intervention (especially India’s proposed SAT‑based reform), and unit‑economics compression. Professional certification prep (7.2% CAGR) outpaces academic test prep (5.4%), while India’s growth (18.5% CAGR) dwarfs the US (7.9%) despite policy volatility. Certification bodies (ETS, GMAC, exam boards) retain structural moats with 50%+ operating margins, while platform‑only businesses face margin pressure.[^33][^35][^37]

Core findings:

- AI is eroding pricing power in content delivery; durable moats shift to learner data + algorithms.

- India’s market is leveraged to policy outcomes; valuation risk premium required.

- Certification bodies maintain structural dominance; prep platforms only capture the service layer.

Scope, Definition & Systemic Importance

Included

- Academic entrance exams (SAT, ACT, GRE, GMAT, NEET, JEE, CUET)

- Professional certifications (CPA, CFA, PMP, AWS, Cisco, CompTIA)

- Practice testing, analytics, adaptive platforms, hybrid tutoring

Excluded

- Accredited degree programs

- Corporate L&D not tied to certification

- Language learning not tied to exams (e.g., Duolingo unless IELTS/TOEFL)

Why It Matters

Test prep is a gating mechanism for higher education, professional licensing, and workforce mobility. Small efficacy gains translate into large lifetime earnings and institutional access outcomes.

Value Chain & Ecosystem

Front‑End (Delivery)

Jobs to be done: structure exam content, deliver feedback, build confidence, reduce time to score.

Revenue models: subscriptions, one‑time bundles, freemium + upsell, tutoring marketplace commissions.

Incumbent position: declining due to AI content commoditization and free distribution.

Middle‑Layer (Content + Trust)

Publishers and curriculum designers face erosion as AI generates 80%‑quality content at 1/10th cost. White‑label LMS platforms proliferate, reducing differentiation.[^1][^2]

Back‑End (Certification)

Certification bodies (ETS, GMAC, exam boards) hold structural monopoly power, capturing 50%+ margins and controlling exam definitions.[^3]

Market Sizing & Growth

Key takeaways:

- The US market grows at ~7.9% CAGR while India grows at ~18.5% CAGR, creating asymmetric growth opportunities.

- Professional certification prep outpaces academic test prep, driven by workforce reskilling and employer recognition.

Key Players & Competitive Landscape

United States

- Incumbents: Kaplan, Princeton Review, Pearson, McGraw‑Hill

- Challengers: Khan Academy (free), BenchPrep (B2B), Magoosh

- AI‑native: Acely, RevisionDojo

India

- Leaders: Unacademy, Vedantu, PhysicsWallah

- Distressed incumbent: BYJU’S (insolvency 2024)

- Professional certs: Simplilearn

Gulf (Secondary)

- English proficiency and professional certs drive demand; reliance on US/India platforms

- Government procurement and curriculum alignment determine market access

Economics & Unit Metrics

| Metric | Incumbents (Kaplan) | Challengers (Unacademy) | AI‑Native (Acely) | Certification Bodies (ETS) |

|---|---|---|---|---|

| CAC | $200–500 | $50–150 | $20–50 | N/A |

| LTV | $2,000–4,000 | $300–800 | $50–200 | $300–500 |

| LTV/CAC | 8–10x | 3–5x | 1–3x | 50–100x |

| Payback | 3–6 months | 6–12 months | 12–24+ | <1 month |

Case study: BYJU’S FY22 burn illustrates unsustainable unit economics (₹5,015Cr revenue vs ₹8,245Cr loss).[^4][^5]

US vs India Market Dynamics

| Dimension | United States | India | Implication |

|---|---|---|---|

| Market growth (CAGR) | 7.9% | 18.5% | India growing 2.3x faster |

| ARPU (annual) | $500–2,000 | ₹30K–₹100K (~$360–1,200) | US higher willingness to pay |

| Regulatory risk | Low–Medium | High (SAT reform) | India needs policy risk discount |

| Market structure | Consolidated | Fragmented | India consolidation likely by 2027 |

| Distribution | Paid + institutional | Free‑to‑paid (YouTube) | India favors freemium conversion |

Regulatory & Policy Landscape

India

Proposed SAT‑based admissions reform could reduce NEET/JEE coaching demand by 40–60% by 2028 if approved (70% probability).[^6][^7][^8]

Policy mechanics:

- SAT‑style exam twice yearly (April/November) for Class 11

- Final percentile combines SAT score + Class 12 board marks

- Coaching hour caps and under‑16 restrictions proposed

United States

FTC COPPA Rule updates (2025) tighten parental consent and data minimization, increasing compliance costs and accelerating consolidation.[^9][^10][^12]

Implications:

- Higher compliance overhead ($100K–$500K one‑time; $50K–$200K annually)

- Data monetization constraints for under‑13 users

- Consolidation pressure for sub‑$10M revenue platforms

AI Impact Analysis

Efficiency gains

- Adaptive learning paths, automated grading, and AI‑generated question banks cut content cost 60–75%.[^20]

Structural shifts

- Personalized sequences replace cohort pacing; tutoring margins compress 30–50%.

Moat erosion

- Content IP and tutoring labor arbitrage commoditize; data + algorithms become moats.

New risks

- Hallucinations, bias, privacy compliance, and integrity risks; QA overhead erodes AI cost savings.[^21][^22]

What Breaks / Converges / Commoditizes

Breaks: per‑student economics of human tutoring; content licensing; tutor labor arbitrage.

Converges: B2C + B2B models; multi‑exam platforms; hybrid delivery.

Commoditizes: question banks, analytics dashboards, white‑label LMS features.

Capital Stack & Incentives

Global EdTech funding is down, but India capital surged 5x in H1 2025. Series‑A graduation rates are collapsing (41% → 12%), forcing stricter unit‑economics discipline.[^29][^30][^32]

Funding patterns:

- US capital cautious; India seeing rebound as policy tailwinds form

- Certification bodies remain self‑funded with high margins

- AI‑native startups face rapid commoditization without data moats

Predictions & Futures

- Professional certification prep outpaces academic test prep (High).

- India SAT reform likely by 2027; creates structural demand shift (High).

- AI‑generated test content becomes standard within 18–24 months (High).

- Test prep consolidation accelerates (Medium).

- Privacy compliance drives consolidation among smaller players (Medium).

FAQs

What is included in test prep and professional certifications?

Platforms for standardized academic exams, professional certifications, and licensing prep with practice testing and analytics.

What is excluded?

Accredited degree programs and corporate L&D not tied to certification.

What are the biggest risks in this segment?

AI commoditization, policy volatility (especially India), and rising compliance costs.

Curated Research & Sources

| Source | Citation | SQI | Why It Matters |

|---|---|---|---|

| Technavio US Test Prep Market | https://www.technavio.com/report/test-preparation-market-industry-in-the-us-analysis | A | US market baseline |

| Technavio India Test Prep | https://www.technavio.com/report/test-preparation-marketin-india-industry-size-analysis | A | India growth thesis |

| FTC COPPA Rule Update | https://www.dataprotectionreport.com/2025/01/ftc-finalizes-coppa-rule-amendments/ | A+ | Compliance driver |

| Entrackr BYJU’S Financials | https://entrackr.com/2024/01/byjus-posts-rs-5015-cr-revenue-and-rs-8245-cr-loss-in-fy22/ | A+ | Unit economics warning |

| GMAT Profit Margins | https://fortune.com/2014/02/11/the-gmat-an-exam-with-greater-profit-margins-than-apple/ | A | Certification body moat |

| Statista Professional Certificates (India) | https://www.statista.com/outlook/emo/online-education/professional-certificates/india | A | Certification demand signal |

| DataHorizzon Test Prep Market | https://datahorizzonresearch.com/test-preparation-market-63302 | B | Market sizing triangulation |

References

Show full reference list

- https://www.ispringsolutions.com/blog/white-label-lms-platforms

- https://www.educate-me.co/blog/white-label-lms-platforms

- https://fortune.com/2014/02/11/the-gmat-an-exam-with-greater-profit-margins-than-apple/

- https://entrackr.com/2024/01/byjus-posts-rs-5015-cr-revenue-and-rs-8245-cr-loss-in-fy22/

- https://www.ndtvprofit.com/business/billion-dollar-darling-to-breakdown-the-rise-peak-and-collapse-of-byjus-all-you-need-to-know

- https://edinbox.com/index.php/news/7280-neet-jee-cuet-will-be-stopped-government-plans-sat-based-admission-revolution

- https://organiser.org/2025/11/30/328101/bharat/govt-mulls-integrating-jee-neet-cuet-into-school-curriculum-a-step-aimed-to-reduce-dependence-on-coaching/

- https://indianexpress.com/article/education/cap-coaching-hours-align-curricula-with-jee-and-neet-centres-panel-10469941/

- https://www.dataprotectionreport.com/2025/01/ftc-finalizes-coppa-rule-amendments/

- https://www.k12dive.com/news/ftc-finalizes-coppa-rule-children-data-privacy/738077/

- https://kingspry.com/new-ftc-rule-on-childrens-online-privacy/

- https://www.dataprivacyandsecurityinsider.com/2025/01/ftc-announces-updates-to-coppa-rule/

- https://itif.org/publications/2025/02/28/new-ftc-coppa-rule-update-does-little-to-protect-children-online/

- https://www.verifyed.io/blog/micro-credentials-guide-7a6c9

- https://business.edx.org/product-update/micro-credentials-reshaping-universities/

- https://www.revisiondojo.com/blog/the-rise-of-ai-based-sat-prep-platforms-in-2025-7-breakthrough-trends-transforming-test-prep

- https://acely.ai

- https://undergrad.wizako.com/blog/standardized-tests/sat-exam/new-digital-sat-format/

- https://academyocean.com

- https://raccoongang.com/blog/how-much-does-it-cost-create-online-course/

- https://www.protecto.ai/blog/understanding-common-issues-in-llm-accuracy/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC11745146/

- https://www.devopsschool.com/blog/top-10-ai-exam-preparation-tools-in-2025-features-pros-cons-comparison/

- https://poetsandquantsforundergrads.com/admissions/the-gre-gmat-today-insights-from-a-test-prep-expert/

- https://magoosh.com/gre/gmat-vs-gre/

- https://www.linkedin.com/posts/rajat-sadana_gmat-vs-gre-which-test-is-right-for-you-activity-7328705796798562304-zarC

- https://arxiv.org/html/2506.11094v2

- https://platform.openai.com/docs/guides/optimizing-llm-accuracy

- https://qubit.capital/blog/edtech-startups-funding-approaches-insights

- https://news.crunchbase.com/venture/edtech-funding-stays-low/

- https://www.ellty.com/blog/edtech-investors

- https://www.outlookbusiness.com/start-up/investors/indian-edtech-start-ups-make-a-comeback-with-5x-funding-surge-in-h1-2025

- https://datahorizzonresearch.com/test-preparation-market-63302

- https://studypdf.net/tools/best-ai-platform-for-automatic-exam-preparation

- https://www.technavio.com/report/test-preparation-market-industry-in-the-us-analysis

- https://www.statista.com/outlook/emo/online-education/professional-certificates/india

- https://www.technavio.com/report/test-preparation-marketin-india-industry-size-analysis

- https://datahorizzonresearch.com/test-preparation-market-63302

- https://finance.yahoo.com/news/test-preparation-market-hit-usd-135100319.html

- https://finance.yahoo.com/news/test-preparation-market-grow-usd-021700609.html

- https://www.researchandmarkets.com/report/united-states-test-preparation-market

- https://www.thebusinessresearchcompany.com/report/exam-preparation-and-tutoring-global-market-report

- https://www.cognitivemarketresearch.com/test-preparation-market-report

- https://www.verifiedmarketreports.com/product/test-preparation-market/

- https://theprint.in/feature/number-of-ways-govt-tried-to-regulate-indias-coaching-centres-since-2021/2828764/

- https://edinbox.com/index.php/news/7280-neet-jee-cuet-will-be-stopped-government-plans-sat-based-admission-revolution

- https://organiser.org/2025/11/30/328101/bharat/govt-mulls-integrating-jee-neet-cuet-into-school-curriculum-a-step-aimed-to-reduce-dependence-on-coaching/

- https://indianexpress.com/article/education/cap-coaching-hours-align-curricula-with-jee-and-neet-centres-panel-10469941/