Case Study: The $50M SaaS Company With 9 Tools, 3 Dashboards, and Zero Forecast Accuracy

Executive Summary

"TechFlow," a $50M ARR B2B SaaS company, had a data problem disguised as a sales problem. They owned 9 different revenue tools—Salesforce, Gong, Clari, Outreach, 6sense, and four others—yet their CEO could not predict the quarter's revenue within a 40% margin of error.

The problem was Tool Debt. Every new tool added friction, not clarity. Data was siloed, definitions of "qualified lead" conflicted, and the sales team spent 12 hours a week updating fields instead of selling.

By applying Law 7 (ValuationOps) and the AAA Framework (Audit, Align, Automate), TechFlow consolidated their stack, mapped their Flow Mesh, and achieved 95% forecast accuracy in 60 days. They didn't just fix their forecast; they lowered their Internal Risk Index (IRI), directly impacting their enterprise valuation.

Context

TechFlow was a classic Series C success story—growing fast, hiring faster. To support this growth, they bought every "Best in Class" tool on the market.

- The Stack: A $2M/year RevOps budget spread across 9 disconnected platforms.

- The Culture: "If it's not in Salesforce, it doesn't exist"—but nobody put anything in Salesforce because it was too painful.

- The Symptom: The Board meeting was a war zone. The CRO had one number (from Clari), the CFO had another (from NetSuite), and Marketing had a third (from HubSpot).

They were "Data Rich, Insight Poor." The moment was critical because they were preparing for a fundraising round, and their Internal Risk (IRI) was flashing red.

The Core Problem (Classical Consulting Problem Framing)

The primary problem was Forecast Volatility.

- Symptom: Revenue misses of +/- 40%.

- Sub-symptom: "Shadow Accounting"—reps keeping their real deals in spreadsheets because the CRM was untrustworthy.

- Root Friction: Tool Debt. The "Flow" of data was broken by too many gates.

- Canon Violation: Law 5 (Friction is the Enemy) and Law 7 (Processes → KPIs → Valuation).

- Business Impact: High WACC. Investors discounted the company's valuation because they couldn't trust the growth story.

The forecast wasn't wrong because the reps were bad liars; it was wrong because the Flow Mesh was broken.

Diagnostic Breakdown (GFE X-ray Mode)

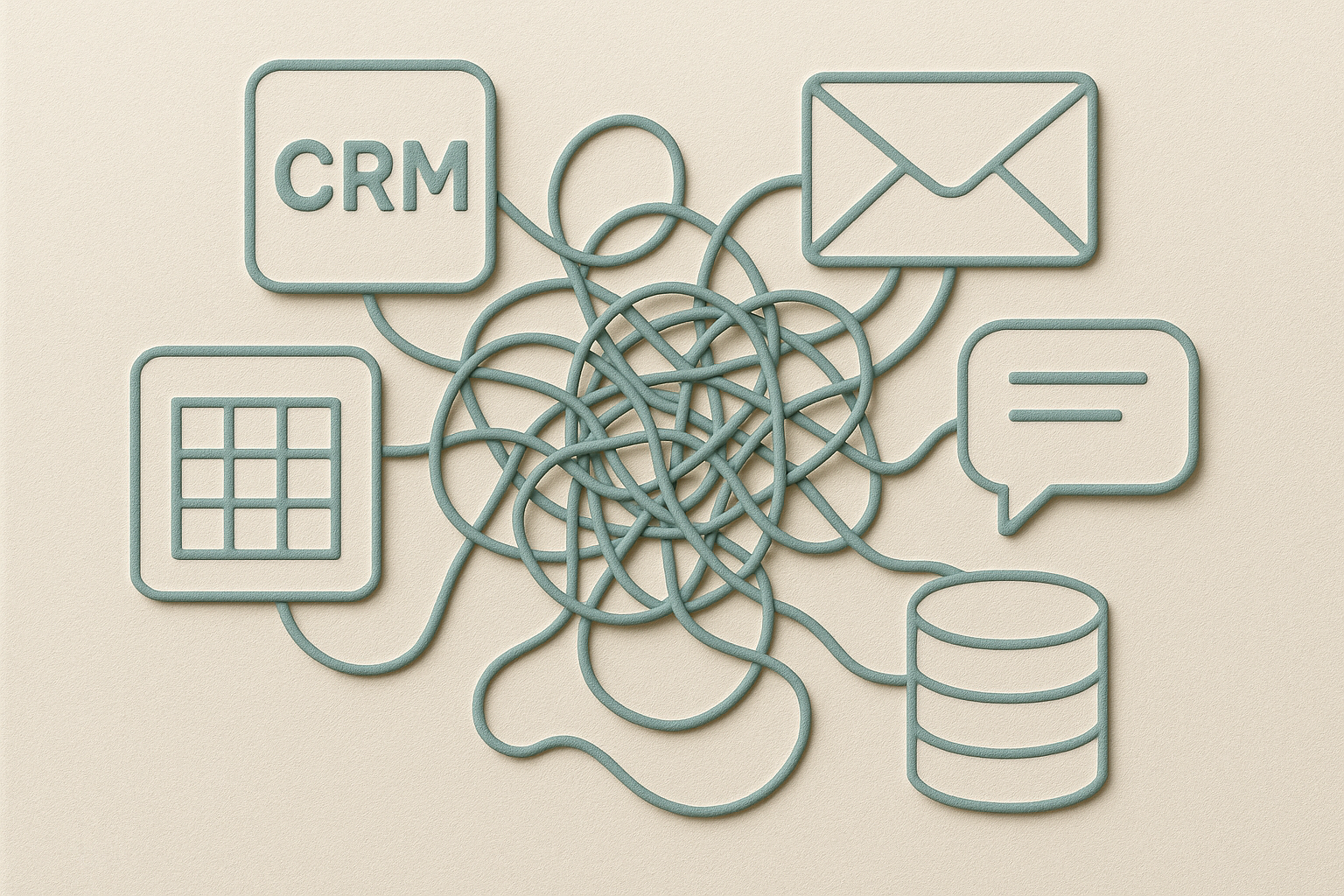

Figure 1: The "Before" state—a tangled Flow Mesh of 9 disconnected tools.

Figure 1: The "Before" state—a tangled Flow Mesh of 9 disconnected tools.

We applied the GFE diagnostic lens:

Flow Mesh Analysis

We mapped the "Lead to Cash" flow. It touched 9 tools and required 14 manual data entry points.

- Result: 40% data decay at every handoff. By the time a lead reached the "Forecast" stage, the data was 3 weeks old.

ValueLogs & LEO

We audited the RevOps team's time.

- Finding: 70% of their time was Earning/Admin (fixing data sync errors), only 10% was Org-Building (improving the model). They were janitors, not architects.

IRI (Internal Risk Index)

TechFlow had a "Tool Debt" score of 9/10. This high IRI meant their Cost of Capital (WACC) was artificially high. They were paying a "chaos tax" on their valuation.

KPI Mapping

We asked: "Does the 'Demo Complete' field in Salesforce map to a Valuation Lever?"

- Answer: No. It mapped to a vanity metric for Marketing. The process was disconnected from value.

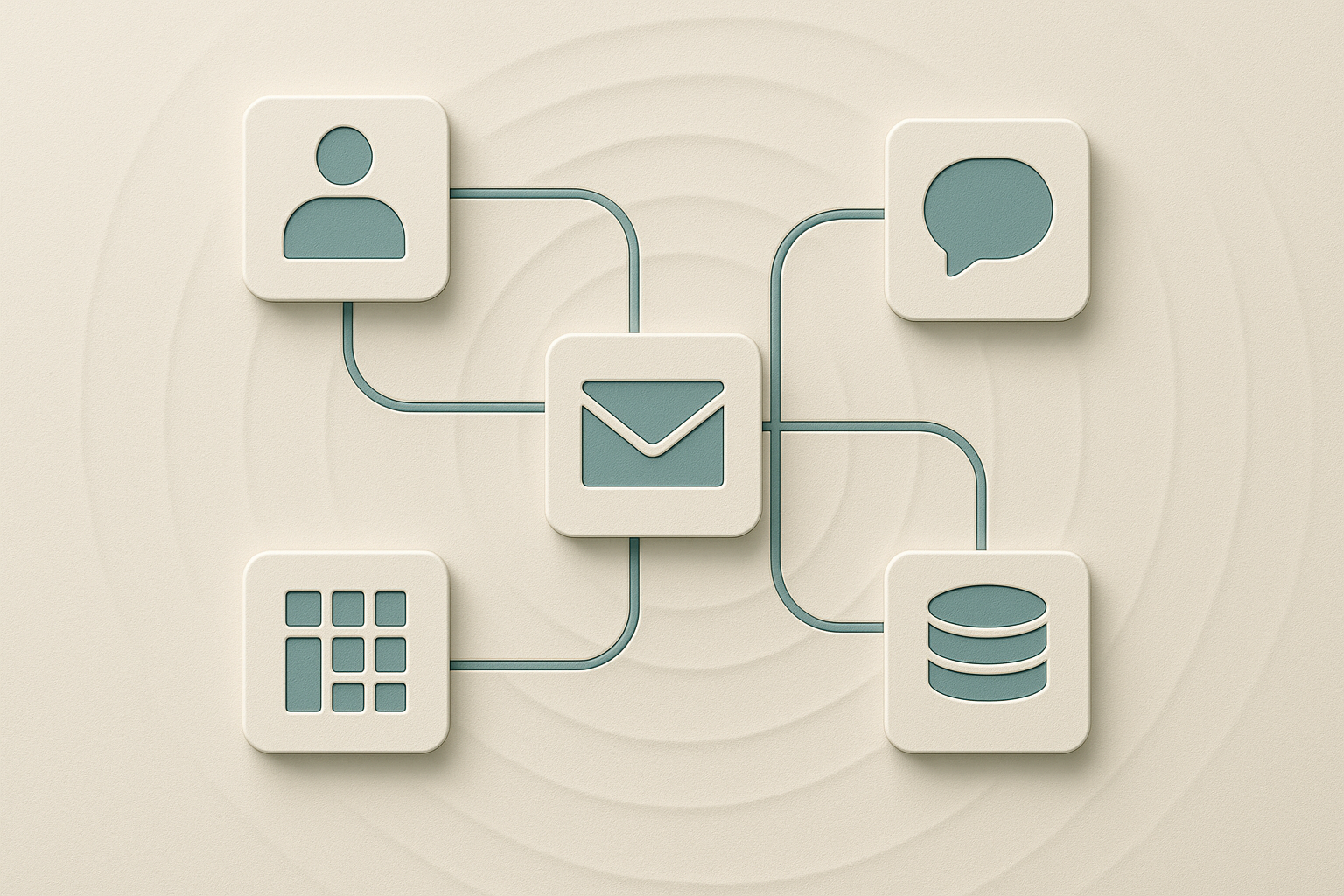

Figure 2: The "After" state—Streamlined Flow Mesh with connected systems.

Figure 2: The "After" state—Streamlined Flow Mesh with connected systems.

Hypothesis Tree

Primary Hypothesis

Forecast accuracy is low because Tool Debt has fragmented the "Source of Truth," causing reps to bypass the system.

Supporting Hypotheses

- H1: Data entry friction is too high (>10 mins/opp), leading to "Shadow Accounting."

- H2: The 9 tools have conflicting definitions of "Stage 2," breaking the Flow Mesh.

- H3: RevOps is spending time on integration maintenance rather than forecast analysis (LEO imbalance).

- H4: Reducing tool count will increase data fidelity (Law 5).

The AAA Transformation

We executed the AAA Loop over 60 days.

Step 1: Audit (Days 1-15)

We ran a Flow Audit. We didn't ask "What tools do we have?" We asked "Where does the data flow?"

- We found 3 "Zombie Tools" (paid for, never logged into).

- We found that the "Forecast" dashboard was manually updated in Excel by the CRO every Sunday night.

Step 2: Align (Days 16-45)

This was the painful part. We declared Bankruptcy on Tool Debt.

- Consolidation: We cut 4 tools immediately. We centered everything back to the CRM + one Intelligence layer.

- Definition Lock: We redefined "Stage 2" not by rep sentiment ("I feel good about this"), but by Proof of Activity (Law 3). No proof (email, meeting, doc sign), no stage advancement.

- The "One Number" Rule: We aligned the CFO and CRO on a single set of KPIs that mapped directly to ValuationOps.

Step 3: Automate (Days 46-60)

Once the flow was clean, we automated it.

- Auto-Capture: We turned on auto-logging for emails and meetings. Reps stopped entering data; the system did it for them.

- Signal-Based Forecasting: We replaced "rep commit" with "signal scoring" (engagement frequency + stakeholder reach).

- Guardrails: We set up alerts. If a deal sat in "Stage 3" for >14 days without Proof of Activity, it was auto-downgraded.

Outcomes

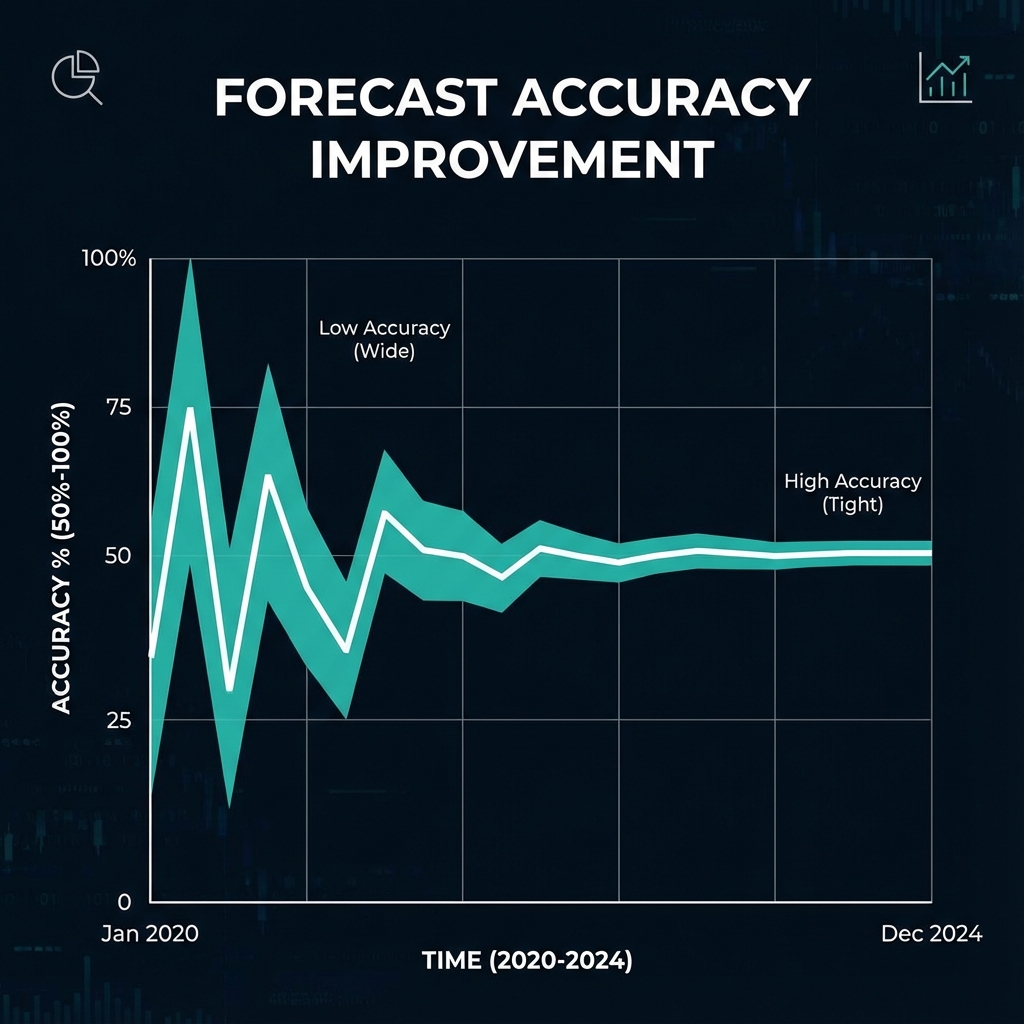

Figure 2: Forecast accuracy converging to 95% after applying Law 7.

Figure 2: Forecast accuracy converging to 95% after applying Law 7.

The results were binary and undeniable.

- Forecast Accuracy: Went from <60% to 95% in the first full quarter.

- Tool Savings: $400k/year saved in licenses and integration costs.

- Rep Productivity: Sales reps reclaimed 8 hours/week (previously spent on data entry).

- IRI Reduction: The "Tool Debt" risk factor dropped from High to Low.

The Board meeting changed from an interrogation to a strategy session.

ValuationOps Impact

How did this change the company's value?

RevenueOps

Speed-to-Lead increased by 30% because data wasn't stuck in sync-limbo between tools.

EBITDAOps

$400k in direct savings dropped straight to the bottom line. At a 10x multiple, that's $4M in Enterprise Value created just by cancelling software.

StoryOps

The narrative shifted from "We are struggling to scale" to "We are a predictable machine."

ValuationOps

By lowering IRI (predictability risk), TechFlow lowered their implied WACC. A predictable $50M company is worth significantly more than a chaotic $50M company.

StoryOps: How the Narrative Changed

The CEO stopped saying, "We think we'll hit the number." He started saying, "The data says we will hit the number, and here is the proof."

This shift in language—from hope to proof—changed investor sentiment. Confidence is a valuation multiplier. TechFlow looked like an AI-Native Organization, not a legacy bloatware company.

Lessons Learned

- More Tools = More Friction (Law 5): Adding a tool to fix a process usually breaks the process further.

- Proof Beats Sentiment (Law 3): Forecasting based on "rep feelings" is gambling. Forecasting based on Proof of Activity is science.

- Tasks Must Map to Valuation (Law 7): If a field in Salesforce doesn't help predict revenue, delete it.

- Tool Debt is Real Debt (Law 8): It compounds. You pay interest on it in the form of confusion and slowness.

What Any Company Can Learn

You don't need to be a $50M SaaS to have this problem.

- If you have more dashboards than decision-makers...

- If your sales reps hate your CRM...

- If your Board asks "Which number is real?"...

Then you have a ValuationOps problem. You are violating Law 7. The solution is not another tool; it is subtraction.

How to Apply This Today

- Audit Your Forecast: Look at your last 3 quarters. What was the variance? If >10%, you have a process problem, not a math problem. questions:

- Does this tool generate Proof of Activity?

- Does the data from this tool map directly to a Valuation Lever?

If the answer is "No," kill it.

Need help mapping your stack? Take the Growth Team Audit or read our guide on Law 6 (AAA).