Law 4: LEO Determines Performance

The Law in One Sentence

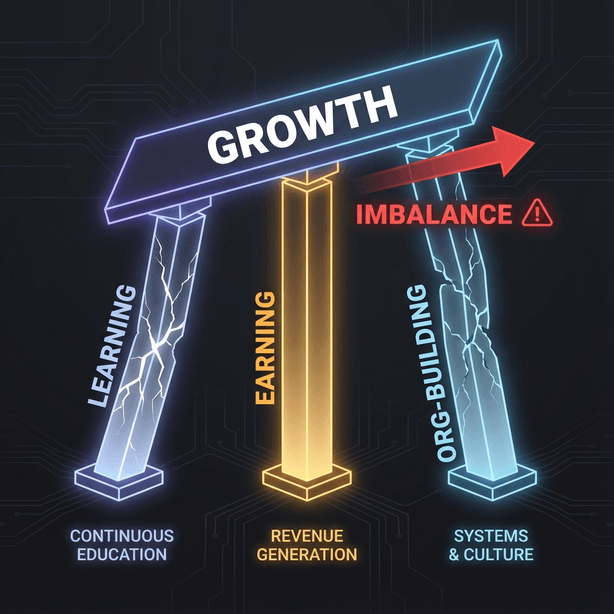

Output metrics are lagging indicators; LEO (Learning, Earning, Org-Building) explains why performance happens.

Why This Law Matters

Most leaders manage by looking in the rearview mirror. They obsess over "Output Metrics"—revenue, leads, shipped features. But these are lagging indicators. By the time you see a dip in revenue, the cause happened three months ago.

The cause is almost always an imbalance in LEO:

- Learning: Gaining new capabilities and market insights.

- Earning: Executing on known value levers (sales, shipping).

- Org-Building: Reducing friction and building capacity (hiring, tooling, process).

When a company focuses 100% on Earning (execution), they hit a "competence trap." They squeeze every drop out of their current model but fail to adapt or build the infrastructure for the next phase. They burn out, debt piles up, and suddenly—growth stalls.

Law 4 shifts your focus from the score (Output) to the gameplay (LEO).

The GFE Interpretation

In the GFE system, every hour of work captured in a ValueLog must be classified into one of three buckets:

Learning (L): "Are we getting smarter?"

- Examples: Customer research, A/B testing, post-mortems, training.

- Risk of neglect: Irrelevance. You execute perfectly on a strategy that no longer works.

Earning (E): "Are we getting richer?"

- Examples: Sales calls, shipping features, running campaigns, support tickets.

- Risk of neglect: Cash crunch. You have great ideas and systems but no revenue.

Org-Building (O): "Are we getting faster?"

- Examples: Hiring, onboarding, refactoring code, documenting processes, automating workflows.

- Risk of neglect: Friction death. Technical and organizational debt crush your velocity.

Healthy Performance is not about maximizing Earning; it's about maintaining the Golden Ratio of LEO for your specific stage. A seed-stage startup might be 60% Learning. A scaling Series B might be 60% Earning. But no stage should be 0% Org-Building.

The Underlying Physics of the Law

1. The Exploration-Exploitation Tradeoff

In systems theory, this is known as the "Exploration (Learning) vs. Exploitation (Earning)" tradeoff. Research confirms that "ambidextrous organizations"—those that can do both simultaneously—outperform those that swing wildly between them. LEO forces you to measure this balance daily, not just in annual strategy retreats.

2. The Debt Compounder

Org-Building is the interest payment on your operational debt. If you ignore it (0% Org-Building), your "friction coefficient" rises. Eventually, 100% of your energy is spent just keeping the lights on (maintenance), leaving 0% for Earning or Learning. This is the "Technical Debt Death Spiral."

3. The Capability Trap

When pressure mounts, leaders instinctively cut Learning and Org-Building to boost Earning. "Stop fixing the process, just sell!" This works for a quarter, but it degrades the machine. It’s like driving a car without changing the oil to save time. You go faster for 100 miles, and then the engine explodes.

Evidence From Research

- Learning Drives Revenue: McKinsey research shows that companies with adaptable, learning-oriented cultures see a 28% increase in revenue over three years compared to peers. Learning isn't a "nice to have"; it's a growth driver.

- The Cost of Ignoring Org-Building: A Stripe study found that developers spend 33-42% of their time dealing with technical debt (bad code, poor tools). That’s nearly half their salary wasted because the organization didn't invest in Org-Building.

- Innovation Speed: 70% of organizations admit that technical debt (lack of Org-Building) significantly hinders their ability to innovate (Protiviti). You cannot build the future on a crumbling foundation.

How This Law Transforms Execution

Applying Law 4 changes the conversation from "Work Harder" to "Work Balancer."

- Diagnostic Clarity: When a team misses a target, you don't ask "Why didn't you work hard?" You check their LEO. "Oh, you spent 95% of your time on Earning and 0% on Org-Building. No wonder you're burning out."

- Protected Capacity: You explicitly allocate budget for Org-Building. "Fridays are for fixing flows." This prevents the debt spiral.

- Strategic Pivots: When you need to pivot, you deliberately dial up Learning. "For the next 6 weeks, we are 80% Learning. Stop selling, start interviewing customers."

- Sustainable Pace: High Earning bursts are sustainable only if followed by Org-Building recovery. LEO makes this rhythm visible.

Case Example: The "Feature Factory" Trap

Context: A SaaS scale-up was shipping features at a breakneck pace (High Earning). Revenue was growing, but churn was spiking, and morale was tanking.

The Struggle: The engineering team was drowning in bugs. Sales was selling features that didn't exist. Support was overwhelmed. The CEO's answer? "Hire more sales reps."

The Violation: The company was running at 90% Earning, 10% Learning, 0% Org-Building. They were mining the asset without maintaining it.

The Intervention: We audited their LEO. The data showed the imbalance. We enforced a "Cool Down" Quarter: 40% Org-Building. They paused new features. They refactored the core codebase, documented the sales process, and trained support (Org-Building).

The Result: Feature velocity doubled the following quarter because the code was cleaner. Churn dropped by 15% because the product was stable. By slowing down to build the org, they sped up.

How to Apply This Law Today

- Tag Your Time: Add a simple L-E-O tag to your ValueLogs.

- Audit Your Week: Look at your last 40 hours. What was your ratio?

- Too much Learning? You might be procrastinating on execution.

- Too much Earning? You are building debt.

- No Org-Building? You are driving toward a cliff.

- Set a Target Ratio: Define what "healthy" looks like for your team right now. (e.g., 10% L / 70% E / 20% O).

- Defend the "O": When deadlines loom, Org-Building is the first thing to get cut3. Prune LEO 4: Identify the low-leverage tasks that are eating your time. Delegate them, automate them, or delete them.

Signs You Are Violating This Law

- The "Hero" Culture: Everything relies on a few people working nights and weekends (High Earning, Low Org-Building).

- Recurring Problems: You solve the same issue every month because you never fixed the root cause (Low Org-Building).

- Strategy Drift: You are executing hard on a plan that is 2 years old and no longer matches the market (Low Learning).

- Zombie Projects: Projects that never die but never ship (High Learning, Low Earning).

How This Law Links to Valuation

Law 4 protects the Asset Value of the organization.

- Learning increases Intangible Assets (IP, market knowledge).

- Earning increases Cash Flow (Revenue, EBITDA).

- Org-Building reduces Liabilities (Operational Risk, Tech Debt).

A company with high Earning but zero Org-Building is like a house with termites. It looks great on the P&L today, but the valuation will collapse during due diligence when the buyer sees the mess inside. Balanced LEO creates premium valuation.

Closing Narrative

Performance is not a sprint; it’s a portfolio. You are investing your time into three buckets every day.

If you only Earn, you will eventually go bankrupt on ideas and infrastructure. If you only Learn, you will be the smartest broke company in the world. If you only Build, you will have a perfect machine that does nothing.

Law 4 is the discipline of balance. It is the wisdom to know which engine to rev, and when.

LEO determines performance. Balance determines longevity.