Law 7: Processes → KPIs → Valuation

The Law in One Sentence

Every task connects to a process, every process to a KPI, every KPI to a valuation driver—ValuationOps rewires execution so work and worth are the same conversation.

Why This Law Matters

Most organizations have two separate worlds:

- The Execution World: Where people do work, complete tasks, and run processes.

- The Valuation World: Where CFOs, investors, and boards talk about multiples, EBITDA, and ARR.

These worlds rarely communicate. The engineer who optimizes the deployment pipeline doesn't know that their work improved "Free Cash Flow Conversion." The salesperson who closes a deal doesn't realize they just increased "Customer Acquisition Cost efficiency," a key valuation metric.

Law 7 bridges these worlds. It states that every piece of work—no matter how tactical—connects to the company's value. But that connection is invisible unless you build the traceline:

Task → Process → KPI → Valuation Driver

When this traceline is visible, execution and valuation become the same conversation. Employees understand how their work makes the company more valuable. Leaders understand which processes to optimize to increase multiples.

The GFE Interpretation

The Four-Layer Model

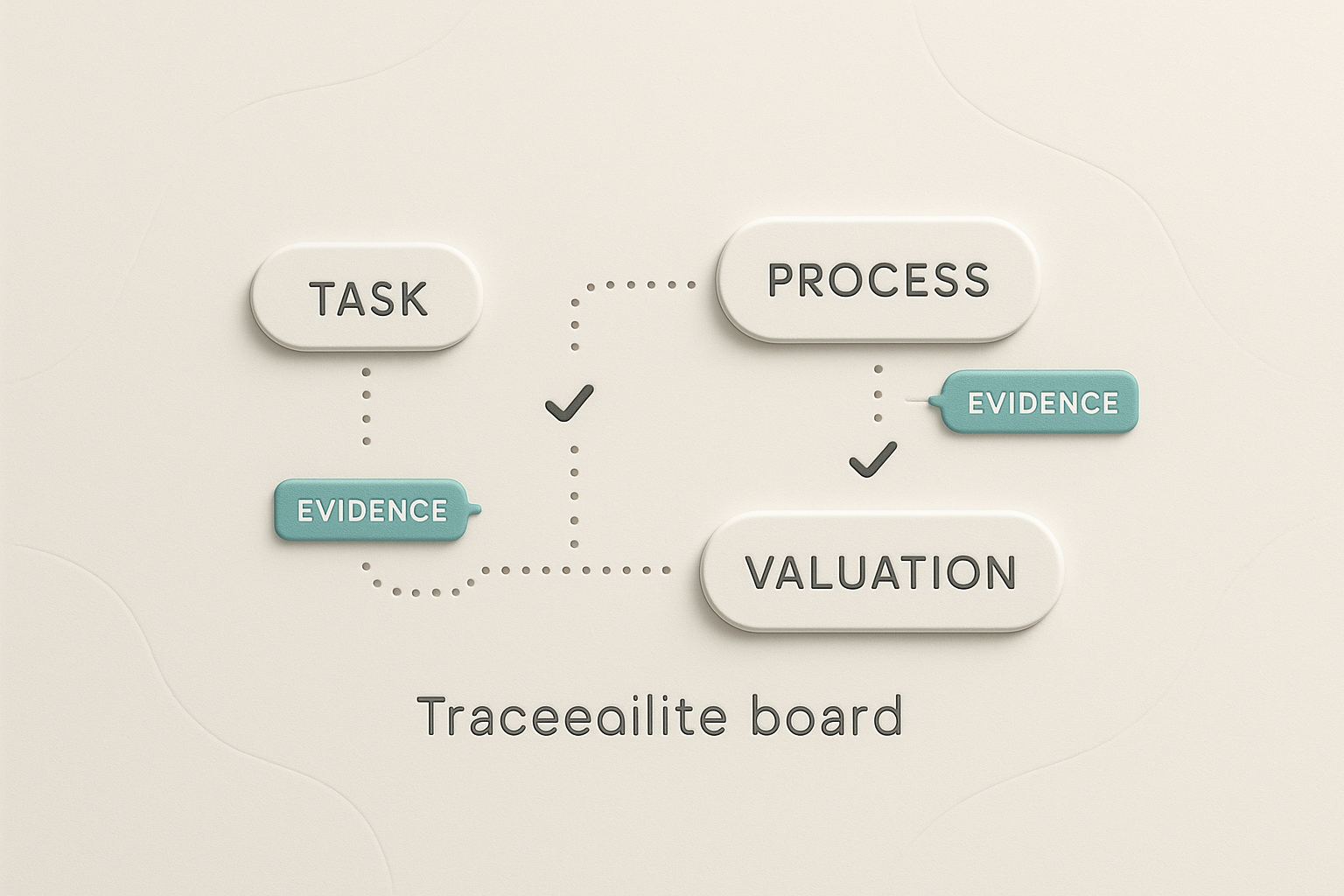

In GFE, we enforce a strict hierarchy:

1. Task (The Atomic Unit)

A Task is the smallest unit of work. It's captured in a ValueLog: Start time, end time, activity, proof.

Example: "Deployed feature X to production."

2. Process (The Workflow)

A Process is a repeatable sequence of tasks that achieves an outcome. It's mapped in a Flow: People, steps, tools, decisions, metrics, dependencies.

Example: "Code Deployment Process" (Write code → Review → Test → Deploy → Monitor).

3. KPI (The Performance Metric)

A KPI is a quantifiable measure of how well a process performs. It tracks efficiency, quality, or output.

Example: "Deployment Frequency" (How many times per week we deploy).

4. Valuation Driver (The Market Signal)

A Valuation Driver is a metric that investors use to assess company worth. It's what moves your multiple.

Example: "Product Velocity" (a proxy for innovation speed, which influences growth multiples in tech).

The Traceline in Action

Let's trace a single task all the way to valuation:

- Task: Engineer deploys a hotfix in 30 minutes.

- Process: This task is part of the "Incident Response Process."

- KPI: The KPI for this process is "Mean Time to Recovery (MTTR)."

- Valuation Driver: MTTR impacts "System Reliability," which influences "Customer Retention," which drives "Net Revenue Retention (NRR)," a critical valuation multiple for SaaS companies.

The Insight: That 30-minute hotfix just protected the company's NRR—and therefore its valuation.

Without the traceline, the engineer just "fixed a bug." With it, they "defended a 10x ARR multiple."

The Underlying Physics of the Law

1. The Law of Compounding Legibility

Valuation is a function of legibility. Investors pay a premium for businesses they can understand. When processes are undocumented, KPIs are fuzzy, and the connection to value is unclear, investors discount the valuation ("high risk, low visibility").

When the traceline is crystal clear, they pay more ("low risk, high confidence").

2. The Unit Economics Principle

Every process has unit economics: Cost per output, time per output, quality per output. Optimizing a process improves its unit economics. Better unit economics flow directly into margin-based valuation drivers (e.g., Gross Margin, Operating Margin), which determine EBITDA multiples.

3. The Attention Economy

Employees have finite attention. If they don't know which work creates the most value, they'll distribute effort randomly. Law 7 creates an "attention gradient"—it shows which processes ladder up to high-leverage KPIs, allowing teams to prioritize ruthlessly.

Evidence from Research

Process optimization boosts valuation multiples: Companies that optimize processes report cost savings of 15-25% of operational costs and productivity improvements of 20-30%. These improvements directly enhance profit margins, a key factor in valuation multiples. For example, a business with a 20% profit margin can be valued at double that of a similar business with a 10% profit margin, assuming the same industry multiple.

KPI alignment increases business value: Research shows that when KPIs are properly aligned with strategic goals, companies achieve better decision-making and increased efficiency. Strong performance in KPIs like revenue growth rate, customer retention, and LTV/CAC ratios signals a healthier, more stable business, which investors find attractive and reward with higher revenue multiples.

Operational efficiency drives revenue multiples: Businesses with documented processes and efficient systems are more marketable and receive higher valuations. Operational efficiency reduces risk (making the business more predictable) and enhances growth potential (freeing up capital), both of which justify higher multiples.

How This Law Transforms Execution

Applying Law 7 changes how teams think about their work.

Before Law 7:

- Engineer: "I fixed the CI/CD pipeline."

- CEO: "Cool. How does that help us raise our Series B?"

- Engineer: Shrugs.

After Law 7:

- Engineer: "I reduced deployment time from 60 min to 10 min."

- Process Owner: "That improves our 'Deployment Frequency' KPI from 3x/week to 10x/week."

- CFO: "That increases our 'Product Velocity' metric, which moves us from a 6x ARR multiple to an 8x multiple category for growth-stage B2B SaaS."

- CEO: "Great. Show me the traceline in the board deck."

The work hasn't changed. The visibility has.

Case Example: The "$400K Process Nobody Knew About"

Context: A mid-stage fintech company was preparing for an acquisition. The acquirer's diligence team asked: "What's your Customer Onboarding cycle time?"

The Struggle: Nobody knew. Marketing, Sales, Support, and Product all touched onboarding, but no one owned the end-to-end process. There was no KPI. They scrambled to answer, pulling data from 4 different tools. The answer: "About 45 days, maybe?"

The Violation: They violated Law 7. The onboarding process existed (people did the work), but it wasn't mapped, measured, or connected to valuation. The acquirer saw this as a red flag: "If they can't measure onboarding, what else don't they know?"

The Intervention: We ran an Audit (from Law 6):

- Mapped the Process: Customer Onboarding had 12 steps across 4 teams.

- Defined the KPI: "Time to First Value" (how long until customer extracts value).

- Connected to Valuation: Time to First Value impacts "Customer Activation Rate," which drives "Expansion Revenue," a key metric for fintech multiples.

Once mapped, they discovered the actual cycle time was 72 days (not 45). They optimized it down to 28 days by removing 4 redundant approval steps.

The Result: The acquirer increased their offer by $400K because the optimized onboarding process demonstrated operational maturity and faster revenue realization—both of which reduced risk and justified a higher multiple.

How to Apply This Law Today

- Pick One Process: Choose a critical process (e.g., "Lead to Customer," "Idea to Launch," "Ticket to Resolution").

- Map It: Document the actual steps using Flow Mapping.

- Define the KPI: What metric measures this process's performance? (Cycle time? Conversion rate? Cost per output?)

- Connect to Valuation: Ask: "Which valuation driver does this KPI influence?" (Revenue growth? Margin? Retention?)

- Make It Visible: Add this traceline to your dashboards, OKRs, or board deck.

Signs You Are Violating This Law

- The "I Don't Know" Moment: An investor asks "What's your gross margin per product line?" and you can't answer because processes aren't mapped to cost centers.

- The Vanity KPI: You track a metric ("Website Traffic!") that sounds good but doesn't connect to any valuation driver.

- The Invisible ROI: Your team optimizes a process, but leadership has no idea it improved EBITDA.

- The Misaligned Sprint: Engineering ships features that don't move the needle on any KPI the CEO cares about.

How This Law Ties to Valuation

Law 7 is the foundation of ValuationOps.

ValuationOps is the practice of running your business as if every decision is a valuation decision. Because it is.

When you optimize a process, you don't just "work faster"—you improve a KPI. When you improve a KPI, you don't just "hit a goal"—you increase a valuation driver. When you increase a valuation driver, you don't just "perform better"—you make the company worth more.

Companies that master Law 7 can:

- Raise capital more easily (because they can prove their metrics).

- Command higher multiples (because their processes de-risk the business).

- Scale profitably (because they know which processes create the most value per dollar spent).

Closing Narrative

Imagine you're building a machine. You could build it with random parts, no blueprint, no gauges. It might work. But when you try to sell it, the buyer asks: "How efficient is it? How often does it break? What's the output per hour?" And you shrug.

Or, you could build it with:

- A blueprint (Process Map).

- Gauges (KPIs).

- A spec sheet showing how its performance translates to ROI (Valuation Drivers).

The second machine sells for 10x the price of the first. Not because it works better—but because the buyer can see that it works better.

Your business is the machine. Law 7 is the blueprint.

Processes → KPIs → Valuation. Map the traceline. Make work and worth the same conversation.